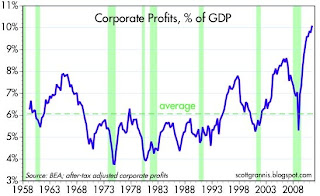

This graph is nothing less than stunning. After-tax

corporate profits as a share of the economy have now skyrocketed far above any

level in the last fifty years.

Many people on the left view the profit surge thru the lens

of class war — that is, the rich are prosecuting a war against everyone else,

pillaging the wealth we all produce jointly and taking it for themselves alone.

The wits among us will respond that it’s not really a war when one side does

all the killing and the other side all the dying. Much of the outrage finally

finding expression in Occupy Wall Street and the other occupations that have

swept the country is based on this way of seeing things.

|

| Source |

As this chart shows quite graphically, such a formulation

isn’t wrong. How else can we explain former Bank of America CEO John Thain’s notorious office renovation, which included two guest chairs for $87,000 and a

$1400 trash can? Or the market for $6400 luxury toilets? Or the regularity

of million-dollar+ birthday parties? All while millions of people, in

the US alone, go without food or shelter or healthcare on a daily basis?

So this understanding captures one facet of our society:

rich people are greedy bastards. But it misses a more fundamental dynamic of

capitalist life, so it remains a one-sided understanding. This leaves us incapable

of grasping the nature of the unfolding crisis of neoliberalism and understanding the tasks that will be necessary to overcome

it.

Under capitalism, every use value acquires an exchange value

that is abstracted from its particularity — namely, its usefulness — and every

unlike thing assumes an equivalency with every other thing, no matter what its

individual nature. The only attribute of exchange value is its numerical

value, it has no concrete expression except in units of currency. Bibles and

whiskey are the same thing: what they’re worth. This is the basis of the

powerful tendency in capitalist society for everything, no matter how sacred or

repulsive, to be reduced to money.

These two dimensions are easily confused. Consider the gross

domestic product, one component of which is the corporate profits seen in the

first graph (the other components are labor income and government revenue).

Fundamentally gdp is an aggregation of all the exchange values produced by the

economy, and doesn’t really tell us much of anything about the use values the

economy is producing. But because we’re so used to buying and selling

everything that maintains our lives, most people see exchange value and simply

imagine what kind of use values it can procure for them. So when they look at

gdp and the parts that compose it, they think in terms of the human welfare

(use values) represented by that exchange value. When a larger share goes to

profits, that means more stuff for the rich and less for everyone else.

Which is correct, but that’s not how corporate executives,

economists, and economic policymakers think. The reason is not that they’re rationalizing their own avarice, but that their experience is based on a part of social life that is qualitatively different from that experienced by most other people. Unlike working people, capitalists

don’t (primarily) sell exchange values in order to purchase the use values that

allow them to live. Their business is exactly the other way around: to sell use

values in order to accumulate exchange values. That is, the only thing they

care about is money.

From the perspective of use value, this looks like nothing

but staggering greed. The massive amounts of money collected by the rich

represent a collection of goods and services — that is, use values — that no

human being could ever use. The majority of the population suffers from a lack

of commodities or, at best, from unstable access to them, while the rich, who want

for nothing, demand ever more of society’s wealth.

But the fact of the matter is, the rich will actually never

consume most of the value they have taken for themselves. They are so

fabulously wealthy that no matter how many $1400 trash cans they bought for themselves,

or how many multimillion-dollar birthday parties they threw for themselves,

they could never exhaust their money. Their hunger for money is driven not by the use values it represents, but by the underlying capitalist dynamic of exchange

value seeking to expand itself.

Marx saw capitalists not as greedy bastards but as

individuals donning a “character-mask” that was generated by forces outside the

individual. That is, the capitalist is performing a social role produced by

modern society that is prior to his or her own individual psychology. Often the

people who fit the role most comfortably are greedy bastards, but if for some

reason there were a shortage of greedy bastards available, other kinds of people

would have to be found to perform the necessary tasks. So the issue isn’t the

rich people themselves, it’s the system that makes the existence of rich people

necessary.

The value of this approach has only increased since Marx’s

time, as the social role of capitalist has increasingly been separated from

particular individuals and split off into the roles of corporate management

(responsible for organizing production and extracting value from the workforce)

and of investors (responsible for channeling capital in ways that will allow it

to expand itself). Confusing the role with the individuals that fill it

obscures the underlying mechanism that reproduces the system, and leaves us

open to the illusion that removing those individuals would end the injustices

of the system.

The point of all this is that when we look at statistics

that contrast the 1 percent with the 99 percent, the incredible wealth of the 1

percent should not be understood as use value they have greedily kept for

themselves, but as capital. The main thing rich people do with their money is

not purchasing luxury goods, but investing it in the hope that it will expand. The

nature of the role is different from that of everyday life, which focuses on

meeting needs. This is how we should understand the comments of one unusually

honest independent trader, who said last month, “The way I think as a trader is different from a human being.”

The extraordinary increase in inequality we’ve seen over the

last three decades was not simply a result of class war by the rich against

everyone else. It was an economic necessity of neoliberalism. With the drop in productivity that marked the end of Fordism, in order to prop up profits and maintain growth it was necessary to

channel greater value to the rich so that investment would not collapse.

That means that, when the right-wing ideologues talk about

the rich as “job creators” and the need to increase their wealth even further to

keep the system healthy, there actually is a kernel of truth there. What’s so

peculiar about capitalism is that it weaves together the interests of the

exploiters and the exploited, so that the welfare of “the 99 percent” becomes

dependent on the capacity of capital to be reinvested, which is what creates jobs and expands the availability of consumer goods. Under normal circumstances, if we simply redistributed the

wealth of society without making any other changes, the total store of capital

would be decimated, investment levels would drop, growth would stall.

In this case, the right is viewing the economy from the standpoint of value rather than use value. From the standpoint of use value (human welfare), on the other hand, of course extreme inequality and unrestrained corporate power are undesirable. But it’s naïve to think we can make changes to society on the basis of human welfare alone — as long as our society remains capitalist, the ongoing accumulation of capital must always be the first priority. When capital catches a cold, the rest of us get pneumonia. (In a capitalist society.)

In this case, the right is viewing the economy from the standpoint of value rather than use value. From the standpoint of use value (human welfare), on the other hand, of course extreme inequality and unrestrained corporate power are undesirable. But it’s naïve to think we can make changes to society on the basis of human welfare alone — as long as our society remains capitalist, the ongoing accumulation of capital must always be the first priority. When capital catches a cold, the rest of us get pneumonia. (In a capitalist society.)

Yet viewing society only from the standpoint of value is also one-sided. Commodities are simultaneously values and use values, which

means that the continuing production and circulation of commodities requires

that both realms be kept in working order. As capital has become more and more

powerful, the relationship between the two has come unhinged. Precisely because

the people supporting Occupy Wall Street understand society from the standpoint

of use value, they have the capacity to correct some of the dysfunctions that

have crippled capital. Severe inequality poses deep problems to the realization of value (the need to actually sell the

products that are made). Unregulated finance, by providing unproductive outlets

to capital, produces sham growth followed by abrupt crashes. Unrestrained corporate power, by

gutting safety and environmental regulations and opening up all kinds of

opportunities for corruption, diverts capital away from productive investment into

schemes for defrauding taxpayers and customers and by shifting costs onto weaker populations. All these dysfunctions are inflating

profits in the short term, but by eroding the social basis for ongoing accumulation they foretell only the coming collapse of profits. In all these ways, the interests

of individual capitalists are degrading the prospects for capital as a whole.

It is

an irony of late neoliberalism, as it was of late liberalism, that the

capitalists and their servants are broadly hostile to the reforms that could

secure their collective interests. They are constrained by ideas that

make sense from the narrow perspective of their individual firm, or by

ideologies that worked while neoliberalism was functional but can now only

intensify the crisis. The other side of this irony is that the people who

consider themselves most critical of capitalism are also its best hope for

revival.

I had made a comment, but it seems to be gone. Was it deleted? Or did I just make some mistake posting it?

ReplyDeleteThe presentation of use-value is not adequate. "Use-value" is a category of capital, not a transhistorical category. Something is a use-value according to the criteria that it has some property which makes it a desirable exchange-value and it can serve as an exchange-value. Plenty of useful things are not use-values in capitalist society. This is connected to the end of the article counterpoising use-value to exchange-value in a way which hypostatizes both rather than seeing them in that inner connection.

ReplyDelete"However, since money as money capital represents the all-embracing and self-referential element in the "valorization of value" (and to this extend it represents the point of departure), the concrete activity of the productive human relationship to nature takes place from the beginning merely with regard to the abstraction, which has literally become real in the property of value and money. Thus the reversal of means and end has its correspondence in the reversal of concrete and abstract; now the concretum is merely the expression of the abstractum, instead of the inverse. Hence, the so-called "concrete labor" and the correlated spectrum of the "use-values" represent not the "good", need-oriented side of the system, but itself the mere concrete form of appearance of the real abstraction, because the concrete operation of production appears on the social level only as the medium of this abstraction. Concrete labor stands not for itself, but is subject to the dictates of the "valorization of value," and, therefore, causes also irrational and destructive results on the level of use-value in spite of the better judgement of all participants, who remain fettered to the structural force of the system." Robert Kurz, Marx 2000.

The problem of the valorization of value is not inequality leading to an inability to buy all of the commodities, (underconsumptionist view). It is a problem of overaccumulation, that is, the inability to valorize the value in what has been produced at an adequate rate or mass of profit. The only way to restore capitalist prosperity is to restore the rate of profit and the mass of profit, which would require the massive destruction of existing capital and the resolving of the mass of 'claims to value' which vastly exceed the 'value which can be valorized'. Since a restoration of capitalist prosperity will be grounded on even less living labor, it would exacerbate the contradiction and lead to the probable increase in the number of human beings organized within a commodity-money economy but who are structurally redundant.

In other words, a downward redistribution of wealth will not improve the economy and a resolution of capitalist profitability allowing for a new cycle of accumulation will not necessarily bring a new prosperity.

There is a further technical problem: GDP is not "an aggregation of all the exchange values produced by the economy", but an aggregate of the "market value" of all final goods and services. It includes income from interest and rent, which technically is double counting surplus value. In an economy where so much "profit" is the result of buying and selling inflated titles to wealth, the profits you are showing in the graph are completely distorted, which is why the crash in 2008 could effectively wipe out all of the wealth that had been "created" between 1997 and 2007. It was a monetary quantity which had no foundation in actually produced goods and services, that is, when the question was raised as to whether or not the promissory notes represented actual assets, the answer for a lot them was "No."

I agree with your comments on use value. In the post I'm trying to home in on what I think is the popular experience of use value, which itself is much more complicated than I allowed without also introducing the notion of a real abstraction, so I admit to some strategic omissions and simplifications here. But I also think it's worthwhile analytically separating the nature of use value in the circuits of capital, which you're pointing to, from the experience of use value in the individual's reproduction of life, which is the raw material of politics.

ReplyDeleteI also agree that reviving accumulation "would require the massive destruction of existing capital and the resolving of the mass of 'claims to value' which vastly exceed the 'value which can be valorized'". The upshot is that some way needs to found of getting all the bad debts produced by financialization off the books to get the economy back into balance. But new sources of value would also be needed (that is, incorporating new pools of labor), as well as a new system of realization (that is, generating demand for new production).

I don't think that recognizing the deep dysfunctions in the process of realizing value as one of the basic obstacles to accumulation is tantamount to a naive underconsumptionism. It's true that some fix to the realization problem could be found that would not involve raising wages, but I'm not sure I've seen an argument that demonstrates the fix can't involve raising wages.